The Hometown Savings Bank offers Traditional, Roth and SEP IRA accounts for your retirement needs along with a Coverdell Education Savings Account for your child’s educational needs.

The Hometown Savings Bank also offers a Health Savings Account, an account used in conjunction with a high-deductible health insurance policy, that allows users to save money tax-free against medical expenses.

When opening an IRA with THSB, you have the option of opening a Certificate of Deposit or Savings Account.

Traditional IRA:

- As a part of the SECURE Act that came into effect January 1, 2020, there is no longer a maximum age to contribute to a Traditional IRA, as long as you have earned income, or are married to a spouse who has earned income, and you file a joint tax return.

- Allows you to defer taxes on your earnings until they are withdrawn. Also, certain contributions are tax-deductible in the year they are made.

- You can withdraw funds from your traditional IRA without incurring a 10% IRS premature-distribution penalty after you reach age 59 ½ (THSB may impose an early withdrawal penalty).

- If you meet certain exceptions, you can avoid the 10% IRS penalty for distributions before age 59 ½. (THSB penalties would still apply.)

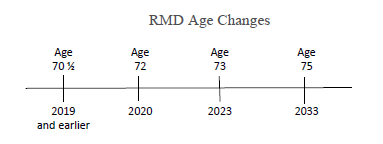

- Required Minimum distributions must begin when you reach your Required Beginning Date or IRS penalties will be imposed. The SECURE Act of 2019 increased the RMD age from 70 1/2 to 72. The SECURE 2.0 Act of 2022 has delayed the RMD age from 72 to 73 beginning in 2023 and will increase again in 2033 to age 75. (See reference chart below.)

Roth IRA:

- There is no minimum age to open or contribute to a Roth IRA if the individual has earned income and files a tax return. If married, both qualify to contribute to a Roth IRA if one or both have earned income.

- There is no maximum age to open or contribute to a Roth IRA, if you have earned income, or are married to a spouse who has earned income, and you file a joint tax return.

- Distributions from a regular Roth IRA can be taken at any time. A distribution of principal (already-taxed basis) can be taken at any time without being taxed or penalized by the IRS (THSB may impose an early withdrawal penalty).

- Required minimum distributions are not required by the Roth IRA owner.

- Earnings are tax-free and IRS penalty-free after a five-year period has been met and the distribution is considered qualified. The following are considered qualified distributions:

- Distributions beginning at age 59 ½ or older

- Death distributions to beneficiaries

- Disability distributions to owner

- First time homebuyer distribution to owner or qualifying descendants.

SEP IRA:

A Simplified Employee Pension (SEP) plan provides business owners with a simplified method to contribute toward their employees’ retirement as well as their own retirement savings. Contributions are made to an Individual Retirement Account set up for each plan participant (a SEP-IRA).

A SEP-IRA account is a traditional IRA and follows the same investment, distribution and rollover rules as Traditional IRAs.

Coverdell Education Savings Account:

(Formerly known as an Education IRA)

- $2,000.00 annual limit per child

- Qualified distributions are tax-free and include:

- Expenses incurred in connection with the enrollment or attendance of the beneficiary at a public, private or religious school providing elementary or secondary educations

- Post-secondary tuition, fees, textbooks, supplies and equipment

- Post-secondary room and board expenses

- Virtually anyone can contribute, including corporations and other entities.

- Contributions must stop at beneficiary’s 18th birthday, unless the beneficiary qualifies as special needs.

- Funds must be distributed or rolled over by the beneficiary’s 30th birthday, except for special needs beneficiaries.

Health Savings Account (HSA Checking Account)

- No minimum amount required to open this account.

- No minimum balance requirement on this account.

- No monthly maintenance service charge assessed on this account.

- No Overdraft Protection or Overdraft Privilege available with this account.

- Interest is compounded daily and credited monthly.

- Interest is paid on two tiered levels: less than $2,500.00 and $2,500.00 or more.

- A debit card will be provided for this account.

- Pre-selected checks will be issued should the customer so desire.

- Online Banking is available with this account. Contributions up to your IRS contribution limit can be made through Online Banking as well as in person.

Please contact us for more information regarding our IRA or Health Savings Accounts.